In a world where financial stability often seems elusive, a budgeting notebook can be a game-changer. This simple yet powerful tool helps individuals track their income and expenses, making it easier to manage money wisely. Unlike digital apps, a physical notebook offers a tactile experience that many find more engaging and satisfying.

Budgeting Notebook

A budgeting notebook helps individuals organize their finances. They can track daily expenses, monthly income, and long-term financial goals. Consistent use improves awareness of spending habits and provides a clear picture of financial health.

Features of a Budgeting Notebook

-

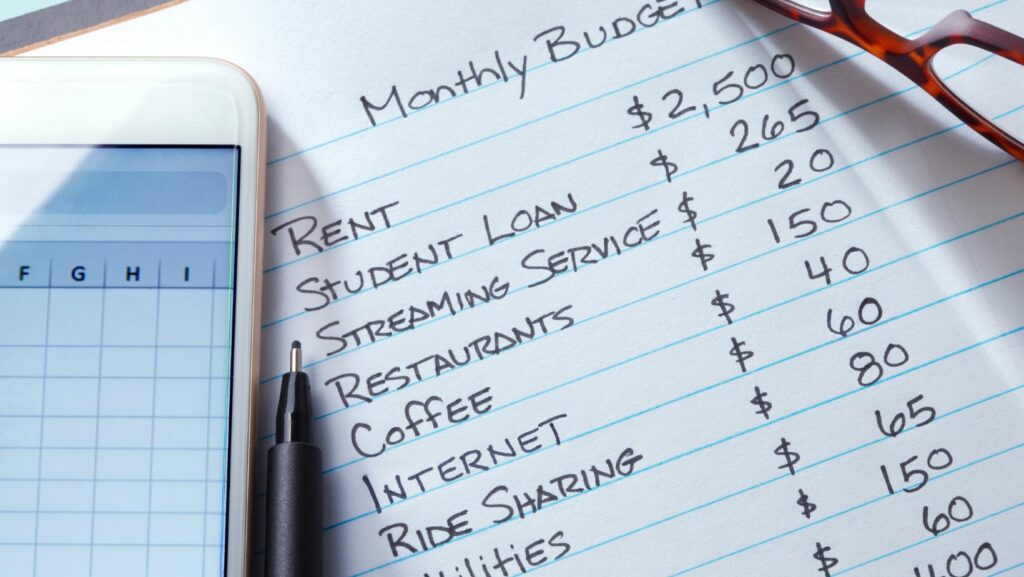

Expense Tracking: Record daily, weekly, and monthly expenses. For example, note groceries, utilities, and entertainment costs.

Expense Tracking: Record daily, weekly, and monthly expenses. For example, note groceries, utilities, and entertainment costs. -

Income Logging: List monthly income sources, such as salary, freelance payments, and side business earnings.

-

Goal Setting: Define financial goals. Examples include saving for a vacation, paying off debt, or building an emergency fund.

-

Budgeting Templates: Use pre-designed templates to simplify budgeting. Templates often include sections for income, expenses, savings, and debt.

-

Expense Categories: Group expenses into categories like housing, transportation, and food. This helps in identifying areas for potential savings.

Types of Budgeting Notebooks

Various types of budgeting notebooks suit different needs. These variations include:

-

Traditional Paper Notebooks: Simple, portable, and customizable on blank or lined pages.

-

Pre-Formatted Budget Planners: Contain pre-designed templates for budgets, expenses, and savings.

-

Digital Budgeting Notebooks: Tablet-friendly PDFs or apps that emulate a paper notebook experience.

-

Customized Notebooks: Personalized with specific sections, such as monthly calendars and goals.

Benefits of Using a Budgeting Notebook

-

Financial Awareness: Enhances understanding of income and expenses, aiding in informed decision-making.

Financial Awareness: Enhances understanding of income and expenses, aiding in informed decision-making. -

Accountability: Writing down expenses fosters accountability and mindfulness in spending.

-

Goal Achievement: Regularly analyzing and adjusting budgets supports progress toward financial goals.

-

Stress Reduction: Organized finances help reduce financial stress and provide a sense of control.

-

Stay Consistent: Update entries regularly to keep the information accurate.

-

Set Reminders: Use calendar reminders to analyze and update the notebook.

-

Be Honest: Record all expenses, even small ones, to get a true financial picture.

-

Evaluate Monthly: Assess the budget monthly to identify trends and make necessary adjustments.

A budgeting notebook serves as a practical tool for achieving financial stability. Its structured approach and tangible format encourage diligence, making the journey to financial well-being more manageable and effective.

Features To Look For In A Budgeting Notebook

Choosing a budgeting notebook requires careful consideration of various features to ensure efficient financial management. Here are key aspects to evaluate when selecting the ideal budgeting notebook:

Design And Layout

A well-organized design and layout simplify tracking and managing finances. Look for notebooks with sections for expense tracking, income logging, and goal setting. Some include pre-formatted budgeting templates and categorized expense sections, aiding in easy data entry and analysis.

Durability And Quality

Durability ensures longevity, even with daily use. Quality materials like hardcover bindings and thick paper prevent wear and tear. Opt for notebooks that resist ink bleed-through and general deterioration, giving confidence that financial records stay intact over time.

Durability ensures longevity, even with daily use. Quality materials like hardcover bindings and thick paper prevent wear and tear. Opt for notebooks that resist ink bleed-through and general deterioration, giving confidence that financial records stay intact over time.

Different financial needs call for varied customization options. Some notebooks offer customizable sections, allowing users to tailor their budgeting system. Stickers, tabs, and bullet points facilitate personalized categorization and indexing, enhancing usability.

Size And Portability

The right size and portability suit different lifestyles. Compact notebooks fit easily into bags for on-the-go tracking, while larger ones provide more space for detailed entries. Consider daily habits and choose a size that balances convenience with functionality.

Benefits Of Using A Budgeting Notebook

Using a budgeting notebook offers a structured approach to managing finances. It helps individuals track their income and expenses, fostering better spending habits and financial stability. Consistent use of a budgeting notebook promotes accountability and keeps financial goals in sight.

With various options like the Clever Fox Budget Planner and Erin Condren Budget Book, there’s a tool for everyone. These notebooks not only assist in detailed expense tracking but also provide motivational features that keep users engaged. By regularly evaluating and adjusting one’s budget, users can stay on top of their financial game.

Ultimately, a budgeting notebook is more than just a tool; it’s a step towards achieving financial freedom and peace of mind.