In the fast-paced world of business, effective budgeting is the cornerstone of successful management. It’s not just about crunching numbers; it’s about making informed decisions that drive growth and sustainability. Managers who master the art of budgeting can allocate resources wisely, anticipate financial challenges, and seize opportunities for expansion.

Budgeting In Management

Effective budgeting in management forms the backbone of strategic planning. It involves setting financial goals, creating projections, and monitoring outcomes to ensure organizations stay on track financially. Proper budgeting facilitates informed decision-making, allowing managers to identify areas needing improvement or investment.

Importance of Budgeting

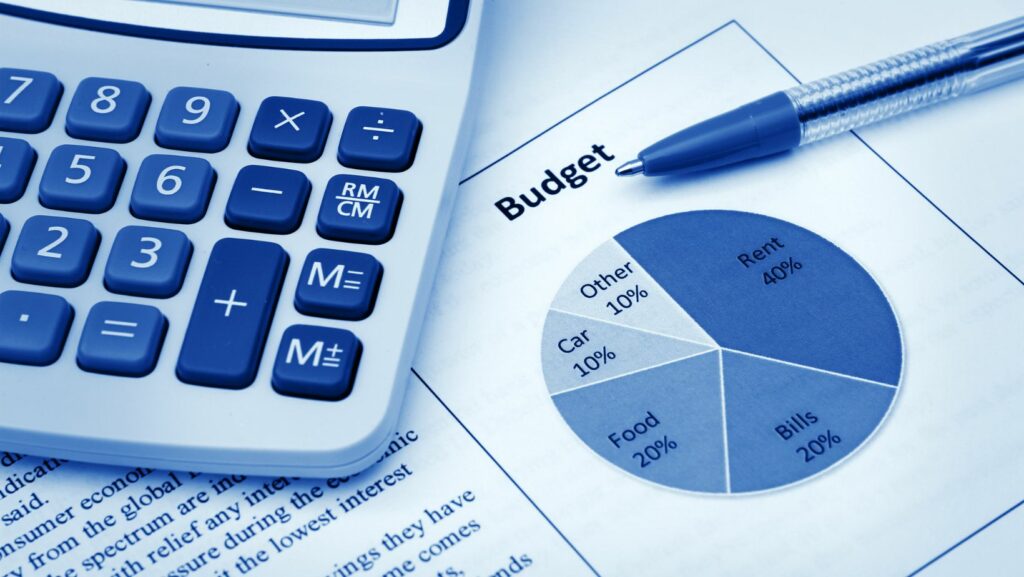

Effective budgeting provides a framework for financial discipline. It helps control expenses, ensuring that resources are allocated efficiently. By identifying priorities, budgeting allows managers to concentrate funds on critical activities.

Types of Budgets

Managers use various types of budgets to address different needs. These include:

Managers use various types of budgets to address different needs. These include:

-

Operating Budget: Covers daily operations expenses such as salaries, rent, and utilities. For example, a department’s budget for office supplies falls under this category.

-

Capital Budget: Used for long-term investments like purchasing new equipment or facilities. For example, acquiring new machinery for a production line is financed through a capital budget.

-

Cash Flow Budget: Projects the cash inflows and outflows over a certain period. An example is planning for the collection of receivables and settlement of payables.

Steps in the Budgeting Process

A structured process ensures a comprehensive budget. The main steps include:

-

Assessment: Analyze past financial performance and current market conditions to forecast future needs.

-

Planning: Set financial goals and define the necessary resources for achieving these goals.

-

Approval: Present the budget to senior management for approval, adjusting based on feedback.

-

Implementation: Allocate resources according to the approved budget plan.

-

Monitoring: Regularly track actual performance against the budget to identify variances.

Challenges in Budgeting

Managers face several challenges when budgeting. Achieving accuracy is difficult due to market volatility. Additionally, unrealistic expectations or lack of buy-in from staff can derail the budgeting process.

Best Practices For Effective Budgeting

Implementing best practices for effective budgeting helps organizations align financial planning with strategic objectives. Adopting these practices ensures more accurate forecasting and efficient resource allocation.

Implementing best practices for effective budgeting helps organizations align financial planning with strategic objectives. Adopting these practices ensures more accurate forecasting and efficient resource allocation.

Engaging stakeholders at all levels promotes transparency and accountability. For instance, involving department heads, finance teams, and executive leadership in the budgeting process helps capture diverse perspectives and fosters commitment to financial goals.

Use Historical Data

Analyzing historical financial data contributes to more accurate budget forecasts. Evaluating previous revenue patterns, expense trends, and economic conditions aids in identifying reliable indicators for future performance. Companies should use data analytics tools to automate and streamline this process.

Set Realistic Goals

Establishing realistic budget goals aligns financial planning with organizational capabilities. Setting achievable targets based on market research and internal performance metrics helps in realistic budget creation. For example, using benchmarks from industry standards aids in setting feasible financial objectives.

Monitor and Adjust Regularly

Ongoing monitoring and adjustment of budgets accommodate changes in the business environment. Organizations should analyze budgets quarterly, assessing variances and making necessary adjustments. This practice ensures responsiveness to unforeseen financial challenges and opportunities.

Ongoing monitoring and adjustment of budgets accommodate changes in the business environment. Organizations should analyze budgets quarterly, assessing variances and making necessary adjustments. This practice ensures responsiveness to unforeseen financial challenges and opportunities.

Effective communication across departments is vital for synchronized financial planning. Encouraging regular meetings and updates among finance, operations, marketing, and sales teams ensures that everyone is on the same page. Tools like collaborative software platforms can facilitate seamless communication.

Prioritize Resource Allocation

Prioritizing resource allocation supports strategic initiatives and maximizes return on investment. Businesses should focus on funding projects with high strategic value, such as product development or market expansion. Resource allocation should reflect the organization’s long-term goals and growth strategies.

Leverage Technology

Leveraging technology enhances budgeting accuracy and efficiency. Implementing financial management software helps automate complex budgeting tasks, reduce errors, and provide real-time financial insights. For example, tools like ERP systems offer integrated solutions for data tracking and analysis.

Conduct Risk Assessment

Incorporating risk assessment into the budgeting process ensures preparedness for potential financial disruptions. Businesses should identify risks such as market volatility, regulatory changes, and technological advancements. Developing contingency plans and allocating funds for unexpected expenses mitigate these risks.